29 Jun New TDS Provisions w.e.f. July 1, 2021

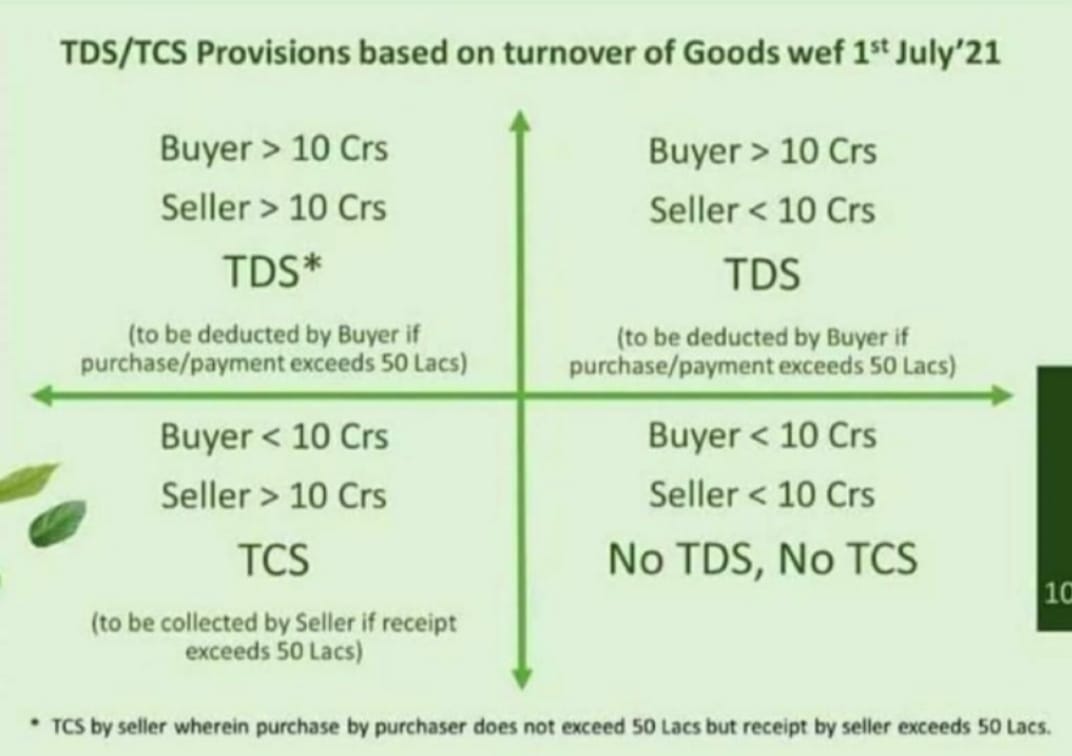

Government of India through Finance Act, 2021 has introduced two new Sections of TDS which shall be applicable w.e.f. Jul 1, 2021. These two new provisions cover TDS on Purchase of Goods and Higher Rate of TDS on non-filers of Income Tax Returns.

In the document provided here, we have explained the applicability of these provisions and necessary changes that may be required in accounting due to these provisions.

We recommend going through the below document for timely implementation of required changes-

Feel free to contact us for any clarifications.

No Comments